Where do they want better prices in? Where do they want range, premium or innovation? Which categories and brands do they want this in the most?

We at Shopper Intelligence often find that FMCG suppliers in New Zealand take Australian data to New Zealand retailers to reflect New Zealand shoppers and the market. We hear “New Zealand is the same as Australia; the shoppers behave the same way.” Whilst there might be some similarities there are more differences in the way shoppers think, how they make decisions and why they do what they do. The market structure is different in New Zealand with distinctive banners with different positioning relative to Coles and Woolworths.

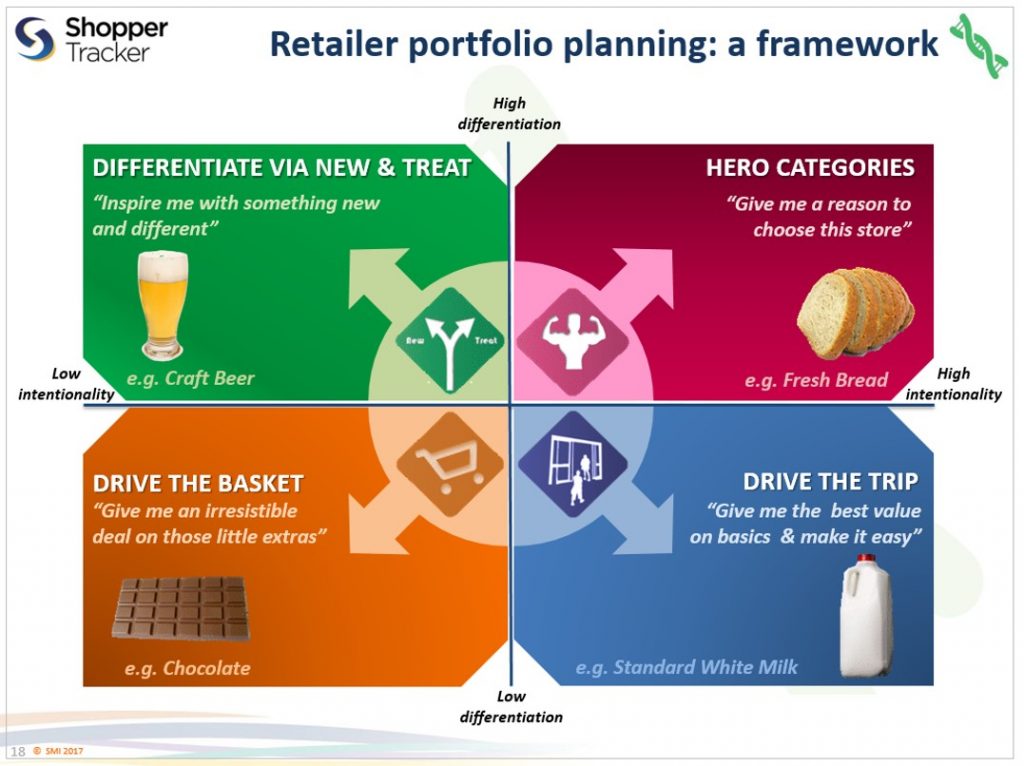

Categories and brands can play different commercial roles for retailers and suppliers. Some categories drive shoppers to store and are highly planned which means we must influence them pre-store whilst others are purely impulsive, shoppers are not thinking about these categories before they walk in the store unless they see something in-store that interrupts them. This has significant implications on availability (e.g. space per sku), range (e.g. key brands blocked or larger rotated range), shelf (e.g. simple and transactional or theatre to entice) and marketing (e.g. pre-store or in-store).

Some categories and brands offer opportunity to trade up and build retailer loyalty. Shoppers say they are willing to pay more for better quality or something different in these categories and will come back to the retailer more often if they deliver to their needs. Other categories are more about delivering the basics of retail, good value and availability.

We therefore need a way to represent these investment decisions through a retailer portfolio planning framework.

Hero categories are where shoppers make decisions to buy into these categories pre-store and in-store expect simplicity, strong availability and they will trade up to more premium options if given enough reason to do so. Examples of this include fresh categories such as meat, bread, fruit and vegetables and areas such as health Foods.

Drive the trip categories are where shoppers seek value and availability. Often, they are products bought in a regular routine manner where we need to facilitate the shop rather than interrupt. Examples include milk, breakfast cereals and mainstream beer.

Drive the basket categories are where shoppers are more likely to make decisions in store. Focusing on a great volume deal, display and linking to a need or occasion helps drive impulse buys and build the basket. Some example categories that fall into this group are confectionery, snacking and non-alcoholic beverages.

Differentiate categories are your premium or new categories where shoppers seek inspiration, innovative ideas and solutions to their key occasions. For example, we know top up missions are on the rise with shoppers thinking about dinner for tonight or the next two to three nights and are looking for meal solution ideas around this. Categories in this group include craft beer, chilled ready meals, frozen meals and hot chicken.

Understanding the role of your categories, brands and segments in Countdown, New World and Pak’nSave and investing appropriately is crucial to be shopper led in decision making.

Author: Mitesh Khatri – Program Director NZ